Choosing the right career path is one of the most important decisions in anyone’s life. With changing technology, AI, and global market shifts, people often wonder whether finance is still a safe and rewarding field. The simple answer is: yes, finance remains one of the strongest, high-paying, and most stable career choices in 2025 especially for beginners.

This guide will explain everything in simple way, so that even someone with zero background in finance can easily understand what the field offers and whether it is the right choice for them.

What Does a Career in Finance Actually Mean?

A career in finance means working in jobs that deal with money management, investment planning, budgeting, accounting, risk analysis, banking, and financial strategy.

Finance professionals help companies or individuals:

- Manage money wisely

- Make profitable decisions

- Reduce financial risks

- Analyze market trends

- Plan for future growth

In short:

Finance is the backbone of every business, organization, and government.

You can also visit our other article: How to Support Youth Entrepreneurship: Practical Steps With Smart Tips

Why Finance Is Still a Popular Career Choice in 2025?

In 2025, financial skills are more valuable than ever. This is because:

1. Businesses need financial experts

Every company needs finance professionals, whether it is a startup, a multinational firm, or a government department.

2. Income levels are higher compared to many fields

Finance jobs often offer above-average starting salaries and excellent growth opportunities.

3. Finance is not affected by AI as much as other fields

AI automates repetitive tasks, but financial decision-making still needs humans.

4. Flexible career paths

Finance allows you to move into investment banking, accounting, fintech, entrepreneurship, auditing, and many other options.

5. Stable demand worldwide

Finance professionals are required in every country.

This makes finance one of the most secure and respected career choices.

The Real Job Market Demand for Finance Professionals:

From 2023–2025, the global finance job market has been growing rapidly. Companies across industries need people who understand:

- Budgeting

- Financial data

- Investments

- Risk

- Economic conditions

In fact, finance jobs have a projected growth rate of 7–10% globally higher than average.

High-demand roles include:

- Financial analysts

- Investment advisors

- Risk managers

- Business analysts

- Corporate financial planners

- Banking officers

- Tax consultants

- Credit analysts

If you enter the field in 2025, job opportunities will continue to grow for the next decade.

High-Paying Finance Roles Beginners Can Start With:

Here are some easy-entry jobs that beginners can pursue:

1. Financial Analyst

You analyze data and help companies make smart financial decisions.

You can also visit Finance Jobs here: Finance Career Guide

2. Accountant / Junior Accountant

Record and manage company finances.

3. Banking Associate

Work in retail, corporate, or investment banking.

4. Financial Planner Assistant

Help professionals plan investments and retirement strategies.

5. Business Analyst

Analyze business processes and improve performance.

6. Credit Officer

Evaluate customer creditworthiness in banks.

7. Insurance Advisor

Guide clients on insurance products and financial protection.

8. Tax Assistant

Help companies or individuals handle tax documentation.

These jobs offer a clear path toward higher-level, high-paying roles.

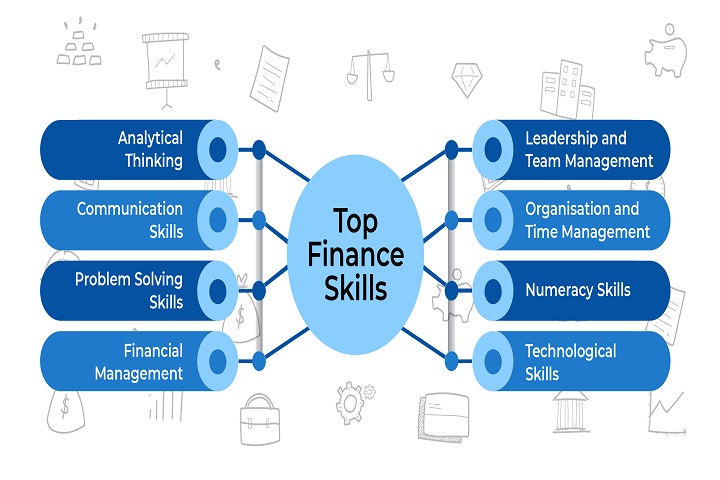

Skills You Need to Build a Strong Career in Finance:

Finance does not require extreme mathematics or genius-level skills.

You only need:

Basic math skills: Addition, percentages, analysis — nothing complicated.

Analytical thinking: Understanding numbers and patterns.

Problem-solving mindset: Finding solutions to financial challenges.

Communication skills: Explaining financial information clearly.

Basic computer skills: Excel, spreadsheets, and financial tools.

Business understanding: Knowing how companies work.

With time, you can also learn:

- Financial modeling

- Investment analysis

- Budget forecasting

- Risk assessment

- Accounting tools

These skills help you grow faster.

How AI and Technology Are Changing Finance in 2025?

AI, automation, and fintech are transforming the finance industry, but in a positive way.

AI handles:

- Repetitive tasks

- Data sorting

- Calculations

- Fraud detection

Humans handle:

- Decision making

- Strategies

- Planning

- Client communication

- Analysis that requires judgment

This means finance jobs are not disappearing, they are evolving.

Beginners who learn financial tools + AI basics will have a huge advantage.

Pros of Choosing Finance as a Career Path:

- High salary potential: Finance roles are among the top-paying careers globally.

- Strong job security: Companies always need financial experts.

- Clear growth path: You can go from analyst → manager → senior manager → director → CFO.

- Work in any industry: Healthcare, tech, banking, real estate, education — finance is everywhere.

- Opportunities for remote jobs: Many finance functions can be done from home.

- Valuable life skills: You also learn to manage your personal finances.

Cons You Should Know Before Entering the Finance Industry:

No career is perfect. Finance also has a few challenges:

- Sometimes work pressure is high: Especially during audits or financial year-end.

- Requires continuous learning: Economy and tax rules keep changing.

- Some roles involve long hours: Investment banking or stock market-related careers.

- Competitive field: Good roles require consistent learning and strong skills.

If you enjoy learning and problem-solving, these cons become manageable.

Is Finance a Good Career for Beginners With No Experience?

Yes, finance is beginner-friendly.

Many people enter finance after studying:

- Business

- Commerce

- Accounting

- Economics

- IT

- Even engineering

You can start with small roles like:

- Assistant accountant

- Banking trainee

- Financial analyst intern

- Billing officer

- Cash officer

The best part?

Beginners can learn and grow fast with the right guidance.

Best Degrees and Certifications for Finance Careers:

Degrees That Help Most

- BBA Finance

- BS Finance

- B.Com

- MBA Finance

- Accounting degrees

- Economics degrees

- Business Analytics degrees

Certifications That Boost Your Career

- CFA (Chartered Financial Analyst)

- ACCA

- CPA

- CMA

- Financial Modeling & Valuation

- Excel Specialization

- Data Analytics for Finance

Certifications make you more competitive and increase earning potential.

Finance vs Accounting: Which One Should You Choose?

Finance and accounting are related but different:

| Finance | Accounting |

|---|---|

| Future planning and forecasting | Recording past financial data |

| More analytical | More compliance-focused |

| Higher salaries in many cases | More stable roles |

| Great for analysts & investment | Great for auditors & tax experts |

| Involves decision making | Involves accuracy & rules |

Expected Salary Range in Finance for 2025:

Finance salaries depend on country, experience, and job role.

Average Starting Salaries for Beginners

- Financial Analyst: Good starting salary

- Accountant: Stable and competitive

- Banking roles: Moderate to high

- Business Analyst: High demand

- Risk Analyst: Above average

With 5–10 years of experience, finance salaries can double or triple.

Senior roles like Finance Manager, Risk Manager, and CFO are extremely high-paying.

Industries That Hire Finance Professionals the Most:

Finance professionals work everywhere, including:

- Banking

- Tech companies

- Government

- Healthcare

- Manufacturing

- Startups

- Insurance

- Real estate

- E-commerce

- Education

- Consulting firms

Every industry needs people who understand money.

Remote Finance Jobs: Can You Work From Home?

Yes, many finance jobs are remote-friendly, especially:

- Accounting

- Bookkeeping

- Financial analysis

- Data analytics

- Online banking support

- Virtual financial planning

With digital tools, remote finance jobs will continue to grow.

How to Start Your Finance Career Step-by-Step?

- 1 Step : Choose your field (banking, analysis, accounting, etc.)

- 2 Step: Complete a degree or short course

- 3 Step: Build your skills (Excel, financial modeling, analysis)

- 4 Step: Create a professional resume

- 5 Step: Apply for internships or entry-level roles

- 6 Step: Get certifications to level up

- 7 Step: Build experience and grow into senior roles

This roadmap works for beginners worldwide.

Common Myths About Finance Careers (And the Truth)

Myth: Finance is only for math experts

✔ Truth: Basic math is enough.

Myth: Finance jobs are boring

✔ Truth: Finance is one of the most dynamic fields.

Myth: AI will replace finance jobs

✔ Truth: AI will assist, but humans remain essential.

Myth: Finance degrees are expensive

✔ Truth: Many affordable online courses are available.

Myth: You need a big network

✔ Truth: Beginners can start small and grow naturally.

Future Outlook: Is Finance a Stable Career After 2025?

The future of finance is very bright.

Trends include:

- AI-powered decision making

- Fintech growth

- Blockchain in finance

- Digital banking

- Big data analytics

- Globalized financial markets

Finance roles will continue to evolve, become more tech-driven, and offer higher salaries.

In short:

Finance will remain a top career field beyond 2030.

Final Verdict: Is Finance the Right Career Path for You?

If you want a career that offers:

✔ High income

✔ Job security

✔ Growth opportunities

✔ Global demand

✔ Flexible working options

✔ Valuable life skills

Then yes — finance is an excellent career path in 2025, especially for beginners. You don’t need to be a genius. You just need interest, consistency, and basic analytical skills.

Finance is a field where beginners grow into experts, and experts grow into leaders.

FAQ: Common Questions Beginners Ask About Finance Careers

Here are short, clear answers for beginners:

1. Is finance hard for beginners?

A. Not really. Basic concepts are easy to learn, and skills improve with practice.

2. Do finance jobs pay well?

A. Yes. Finance is one of the highest-paying business fields.

3. What degree is best for finance?

A. BBA Finance, BS Finance, B.Com, MBA, or accounting degrees.

4. Is finance a stable career?

A. Absolutely. Finance is required in every company and every economy.

5. Can I work in finance without a degree?

A. Yes, through certifications, courses, and entry-level roles.

6. Which finance jobs are best for beginners?

A. Financial analyst, accountant, business analyst, banking trainee.

7. Does finance require advanced math?

A. No. Basic math and logical thinking are enough.